Technology is no stranger to debate. Emacs vs vi, Gnome vs KDE, Mac vs Windows, the list goes on and on with each having inspired debate that would rival the contents of the Library of Congress in quantity, quality and emotion. As more than one technology option became plausible people examined alternatives, made arguments, and began to dig in their heels little-by-little until their position moved from an errant thought, to a reasoned stance, to core belief, and for some, a full-on holy war.

Bitcoin’s block size debate seems to be following the same pattern. People on both sides started with some level of knowledge and when faced with the question, had little difficulty making a choice. Over the past weeks, discussion has grown as suggestions have been made and emotions have driven heated argument peppered with name calling and allusions to ulterior motives.

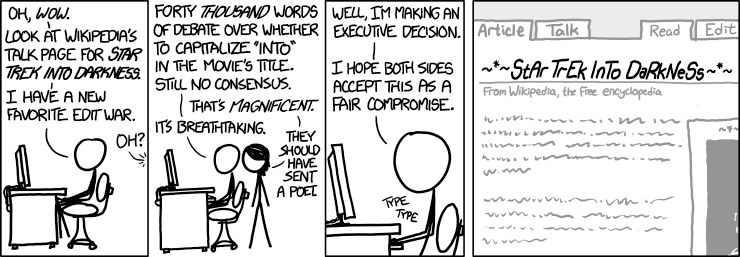

There’s just one difference between this debate and those that went before. Consensus is paramount.

So what if someone else uses a different editor, window manager, or operating system? Sure, it might affect a tribe of developers, or what platform has the best apps but in the end each user can make their own choice, even if that means disowning a family member or two. Unfortunately, “To each his own” doesn’t work for Bitcoin.

Bitcoin is the first at-scale experiment in distributed consensus. With a set of rules that provide viable incentives for all parties, Bitcoin is able to channel astronomical hashrates into global agreement. The math of hashing creates a steadily closing window of uncertainty. A specific chain of blocks either does or doesn’t have more work behind it and so we can mechanically march along in time, adding block upon block to the block chain, cementing in an agreed-upon version of the past.

No it’s not the math that is our current weakness. Instead it is that pesky set of rules. How big should we allow those blocks to be? How many transactions can the system handle before it turns into PayPal? How many users can dip their toe in the water of now before it freezes for all eternity?

Instead of being able to make our own choices to mangle our hands or submit to Bill Gates, we have a decision that will be set in stone for all to see. If we don’t decide the outcome before we decide to decide, we risk losing the vital consensus that we’ve been building for the last six and a half years.

If we impatiently ask the Bitcoin network, including miners and users, to move forward with a hard fork without broad agreement that the change is what’s best for the system, we risk splitting the network into two. People talk about life after an unsuccessful hard fork like it’s something we can deal with. It is not. If any significant fraction of the network bails out of the longest chain agreement, we aren’t left with BitcoinA and BitcoinB. We are left with zilch. It’s not a crash landing or waiting days for confirmation or accepting a little too much centralization that we should fear. An unresolved hard fork is the true nightmare scenario.

With a hasty decision we are not just risking distributed consensus today but we are risking it for a long time. It’s not clear that a catastrophic failure in Bitcoin’s consensus will ever be matched by a similarly free and open system. Those with an interest in breaking such consensus as a cosmic force will be on the lookout for anything that could match it, and may destroy it with hashing not long after birth. Others with the resources to withstand an initial attack may offer a replacement that requires AML/KYC for confirmation and would be no true replacement to Bitcoin.

If you agree, not on a specific course of action, at least agree that this decision is important and that it must be agreed upon before we dare to decide. It must be made with the best information available and it must be made together or not at all. With time circumstances will change, the tech will improve and we will hopefully discover that we are once again on the same side.

For more information on both sides of the debate, add Arguments in the Bitcoin Block Size Debate to your weekend reading list.